Youth Sports Nonprofit Business Plan

YouthSports

Executive Summary

Twenty-five percent of Richmond Metro youth participated in organized sports last year, compared with 85 to 90 percent in the suburbs, according to a recent State University report entitled Richmond's Youth Sport Need Assessment. Currently, there are 40,000 children in the Richmond Metro area between the ages of 6 to 14. In contrast to the metro area, the suburbs have a full array of youth sports with strong financial support. This late start for urban children, especially urban girls, in organized sports robs them of the opportunity for physical activity, coaching, being part of a team, learning skills, and substantial time away from "negative recreation" (drugs, violence or sexual activities).

Clinical studies also show that sports and recreation programs can help youth establish lifelong, healthy, physical activity patterns. Regular physical activity can ward off life-threatening diseases; reduce feelings of depression and anxiety; help control weight and obesity; and build and maintain healthy bones, muscles, and joints, according to the President's Council on Physical Fitness.

The children in the city's core must have the opportunity for a successful start in education and sport regardless of age, race, gender, family composition, income or community. In response to this significant disparity, YouthSports will be created to provide the sports program necessary for Richmond children to have equal opportunity for organized sports.

Thanks to a three-year matching grant from The John Ford Stevenson Foundation (JFSF), YouthSports and several corporate partners plan to utilize organized sports and physical activity programs to promote healthy development in youth.

The JFSF, based in San Francisco, CA, is the nation's largest philanthropy devoted exclusively to health and health care. It concentrates its grantmaking in three goal areas: to assure that all Americans have access to basic health care at reasonable cost; to improve care and support for people with chronic health conditions; and to reduce the personal, social and economic harm caused by substance abuse; tobacco, alcohol, and illicit drugs.

Schools and health care centers will host sport registration. The JFSF renewable matching grant is based on the concept that local funding sources have the clearest understanding of their communities' needs. With matching contributions from local partners, the project will receive substantial funding.

Collaborating partners include:

- BlueCross/BlueShield.

- Mayor Linda Hargrove and the City of Richmond.

- Parks & Recreation Department.

- Richmond Unified School District.

- Templex Corporation.

- A.I. Kaufman and Sons.

- PriceRight Supermarkets.

- Avion Computers.

- The Richmond Mall.

- Richmond Bank.

- Rider Corporation.

With this base of support, YouthSports will raise additional money from program sponsors and fundraising campaigns.

1.1 Objectives

- To increase participation in youth sports and recreation programs in the Richmond Metro area.

- To increase youth access to health care and healthy development.

1.2 Mission

The mission of YouthSports is to create a youth sport program in the Richmond Metro area increasing both sport participation rates and healthy development of the area's youth.

1.3 Keys to Success

- Utilizing the school system to promote the sports program and recruiting team coaches.

- Minimize field maintenance and facility costs with the school and city park systems.

- Maintaining the City Council's support to provide scholarship funds for needy youth who want to participate in sports.

- Recruiting more corporate support for the sports program.

- Maintaining a high approval rate with the area's parents and youth.

Organization Summary

YouthSports will be a private, non-profit, youth sports program serving children, ages 6-14, in the Richmond Metro area. The focus of the program is to promote youth sport participation, promote healthy development in youth, and increase youth access to health care.

YouthSports has rented office space near the city cent park system. Outdoor sports will be played on public school and park property. Indoor sports will be played in public school gyms.

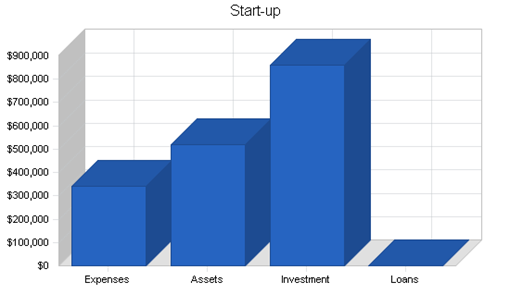

2.1 Start-up Summary

Start-up costs and initial financing are shown on the following tables and chart.

|

Start-up Funding |

|

|

Start-up Expenses to Fund |

$342,000 |

|

Start-up Assets to Fund |

$518,000 |

|

Total Funding Required |

$860,000 |

|

Assets |

|

|

Non-cash Assets from Start-up |

$250,000 |

|

Cash Requirements from Start-up |

$268,000 |

|

Additional Cash Raised |

$0 |

|

Cash Balance on Starting Date |

$268,000 |

|

Total Assets |

$518,000 |

|

Liabilities and Capital |

|

|

Liabilities |

|

|

Current Borrowing |

$0 |

|

Long-term Liabilities |

$0 |

|

Accounts Payable (Outstanding Bills) |

$0 |

|

Other Current Liabilities (interest-free) |

$0 |

|

Total Liabilities |

$0 |

|

Capital |

|

|

Planned Investment |

|

|

JFSF |

$430,000 |

|

Blue Shield/Blue Cross |

$100,000 |

|

Templex Corporation |

$25,000 |

|

A.I. Kaufman and Sons |

$25,000 |

|

PriceRight Supermarkets |

$80,000 |

|

Avion Computers |

$50,000 |

|

The Richmond Mail |

$50,000 |

|

Richmond Bank |

$50,000 |

|

Rider Corporation |

$50,000 |

|

Other |

$0 |

|

Additional Investment Requirement |

$0 |

|

Total Planned Investment |

$860,000 |

|

Loss at Start-up (Start-up Expenses) |

($342,000) |

|

Total Capital |

$518,000 |

|

Total Capital and Liabilities |

$518,000 |

|

Total Funding |

$860,000 |

|

Start-up |

|

|

Requirements |

|

|

Start-up Expenses |

|

|

Legal |

$5,000 |

|

Stationery etc. |

$5,000 |

|

Brochures |

$20,000 |

|

Promotion |

$100,000 |

|

Insurance |

$10,000 |

|

Rent |

$2,000 |

|

Research and Development |

$0 |

|

Sport Equipment |

$100,000 |

|

Office Equipment/Software |

$100,000 |

|

Other |

$0 |

|

Total Start-up Expenses |

$342,000 |

|

Start-up Assets |

|

|

Cash Required |

$268,000 |

|

Other Current Assets |

$50,000 |

|

Long-term Assets |

$200,000 |

|

Total Assets |

$518,000 |

|

Total Requirements |

$860,000 |

Services

YouthSports will offer the following sports during the year:

- Flag Football, August-November.

- 1st/2nd Grade Basketball, October-December.

- 3rd-8th Grade Basketball, December-March.

- Spring Soccer, March-May.

- T-Ball/Softball/Baseball, May-July.

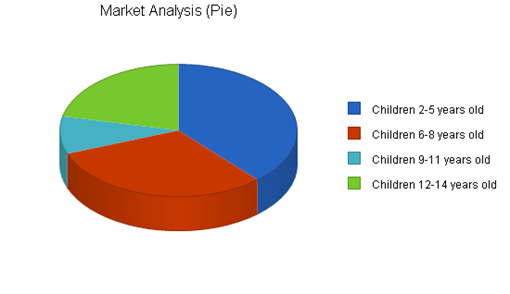

Market Analysis Summary

There are 40,000 children in the Richmond Metro area between six to 14 years of age. The age group percentages break down as follows:

- 50% - Ages 6-8.

- 30% - Ages 9-11.

- 20% - Ages 12-14.

Currently, only 10% of 6 -11 year olds in the Richmond Metro area participate in organized sports. More importantly, only 5% of girls in that age group are involved in sports. The current age break down provides YouthSports with an excellent opportunity to impact half of our target group at the youngest ages. This will have a tremendous impact on the success of the program over the next five years.

It is also important to note that there are over 25,000 children in the Richmond Metro area between the ages of two to five. These children will be entering the YouthSports program within the next three years.

4.1 Market Segmentation

The 2-5 and 6-8 age groups represent over 70% of the children that YouthSports will serve over the next three years. It is critical that the program is prepared to manage the influx of these young children.

|

Market Analysis |

|||||||

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|||

|

Potential Customers |

Growth |

CAGR |

|||||

|

Children 2-5 years old |

8% |

25,000 |

27,000 |

29,160 |

31,493 |

34,012 |

8.00% |

|

Children 6-8 years old |

10% |

20,000 |

22,000 |

24,200 |

26,620 |

29,282 |

10.00% |

|

Children 9-11 years old |

10% |

6,000 |

6,600 |

7,260 |

7,986 |

8,785 |

10.00% |

|

Children 12-14 years old |

8% |

14,000 |

15,120 |

16,330 |

17,636 |

19,047 |

8.00% |

|

Total |

8.81% |

65,000 |

70,720 |

76,950 |

83,735 |

91,126 |

8.81% |

Strategy and Implementation Summary

It is critical that YouthSports takes a proactive strategy in promoting its program in the community as well as creating a strong fund-raising program. To accomplish these goals, YouthSports will have two groups overseeing the program's growth and development. The first will be a 12-member Program Services Group comprising of community members. This group will provide oversight of the program's service delivery to the community and will also be responsible for building community support for YouthSports. The second group will be a 10-member Finance Group that will have Richmond business representation. The Finance Group will have oversight over the program's fiscal operation and fund-raising activities.

The next step will be to recruit the volunteer coaches and facility supervisors for each season and use this group to promote the program at local schools. Coaches and facility supervisors will be recruited by using the community churches and civic organizations. In addition, the Richmond Police Department is initiating a new program to recruit volunteer youth coaches from their own ranks. YouthSports is also working with the Community Service Program of State University to recruit college students as coaches. They will receive three university credits hours for their participation with YouthSports.

Mobilizing a coaching/supervision base will provide YouthSports the people power necessary to get its message to the entire community.

Sign-up for the program will be simplified by providing participation forms at each school and at the larger community markets. At each location, there will be a collection kiosk where the forms can be dropped off.

5.1 Competitive Edge

YouthSports' competitive edge is twofold. One is the support of the community's public resources to build a successful sports program that will have a positive impact on the attitude and health of the area's children.

The school district has committed to strongly pushing the sports program. Each of the area's elementary and middle schools will choose a school team name. The name will then be used by the school teams. Sport participation will be promoted in the classroom and volunteer coaches will be allowed to visit classrooms and speak to the children.

The city park system has been pivotal in obtaining sports equipment for the program at a discounted rate, saving the program a large expense.

The program's second advantage is the support of businesses to have a real impact on the metro youth. The revitalization of the Richmond's urban center can only be built upon the improved quality of life of metro residents. The current demographics, with the majority of metro children under the age of six, provides a unique opportunity to have a dynamic impact on the area's youth. Richmond businesses are lining up to become sport sponsors and school team sponsors.

5.2 Fundraising Strategy

YouthSports will be directing its fund-raising program at two groups. One will be the metro area parents, the other will be Richmond's businesses. Being successful with both groups is key to the program's future.

- Metro Area Parents: The program's expectations is that sign-up fees will pay for only 30% of operating cost but the fee is crucial for several reasons. First, without a sense of ownership in the program the community will not support the program over time. Second, a monetary commitment to the program creates an expectation of services that will push the program to become more responsive to the community needs. The third reason, and the most important, is that the fee is an organizing tool to recruit volunteers who will commit to work a number of hours for the program as part of a child scholarship agreement.

- Richmond Businesses: Local businesses can become sponsors of YouthSports sport seasons (like PriceRight can sponsor the Flag Football Season), school teams, or sport tournaments. With the sponsorship will come the opportunity to have the company name on field/facility banners, team uniforms, and YouthSports mass mailings. YouthSports will also have four high-profile fundraisers each year.

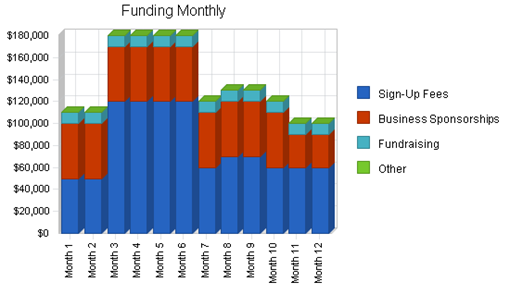

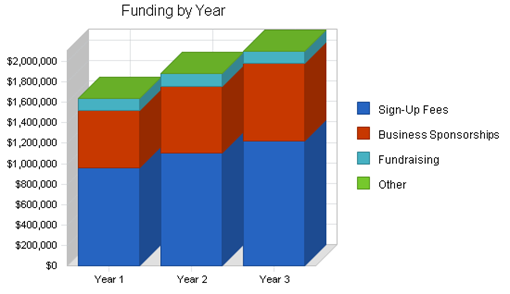

5.2.1 Funding Forecast

The following is the funding forecast for three years.

|

Funding Forecast |

|||

|

Year 1 |

Year 2 |

Year 3 |

|

|

Funding |

|||

|

Sign-Up Fees |

$960,000 |

$1,100,000 |

$1,220,000 |

|

Business Sponsorships |

$560,000 |

$660,000 |

$760,000 |

|

Fundraising |

$120,000 |

$120,000 |

$120,000 |

|

Other |

$0 |

$0 |

$0 |

|

Total Funding |

$1,640,000 |

$1,880,000 |

$2,100,000 |

|

Direct Cost of Funding |

Year 1 |

Year 2 |

Year 3 |

|

Sign-Up Fees |

$0 |

$0 |

$0 |

|

Business Sponsorships |

$12,000 |

$15,000 |

$18,000 |

|

Fundraising |

$12,000 |

$12,000 |

$12,000 |

|

Other |

$0 |

$0 |

$0 |

|

Subtotal Cost of Funding |

$24,000 |

$27,000 |

$30,000 |

Management Summary

YouthSports will establish a team to manage the day to day operation of the program.

6.1 Personnel Plan

The program team will have the following positions:

- Director.

- Assistant Director.

- Volunteer Coordinator.

- Sponsorship/Fundraising Developer.

- Facility Coordinator.

- Coordinator of Game Officials.

- Area Supervisors (3).

- Office Manager.

- Clerical Staff (2).

|

Personnel Plan |

|||

|

Year 1 |

Year 2 |

Year 3 |

|

|

Director |

$36,000 |

$39,000 |

$42,000 |

|

Assistant Director |

$31,200 |

$34,000 |

$37,000 |

|

Volunteer Coordinator |

$30,000 |

$33,000 |

$36,000 |

|

Sponsorship/Fundraising Developer |

$33,600 |

$37,000 |

$40,000 |

|

Facility Coordinator |

$30,000 |

$33,000 |

$36,000 |

|

Coordinator of Game Officials |

$28,800 |

$31,000 |

$34,000 |

|

Area Supervisors (3) |

$72,000 |

$80,000 |

$90,000 |

|

Office Manager |

$30,000 |

$33,000 |

$36,000 |

|

Clerical Staff (2) |

$38,400 |

$41,000 |

$44,000 |

|

Total People |

12 |

12 |

12 |

|

Total Payroll |

$330,000 |

$361,000 |

$395,000 |

Financial Plan

The following is the Financial Plan for YouthSports for three years.

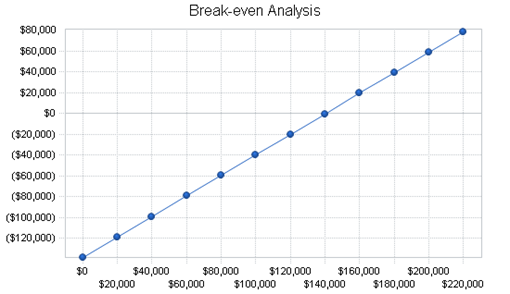

7.1 Break-even Analysis

The following table and chart show the Break-even Analysis for YouthSports.

|

Break-even Analysis |

|

|

Monthly Revenue Break-even |

$140,548 |

|

Assumptions: |

|

|

Average Percent Variable Cost |

1% |

|

Estimated Monthly Fixed Cost |

$138,492 |

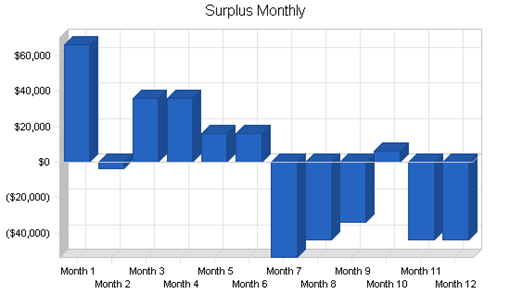

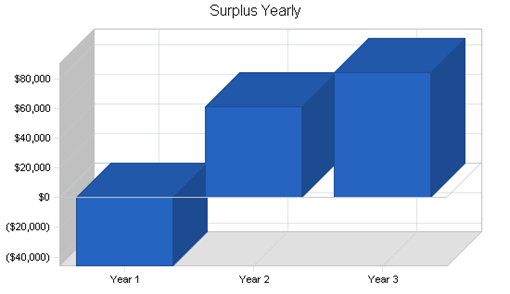

7.2 Projected Surplus or Deficit

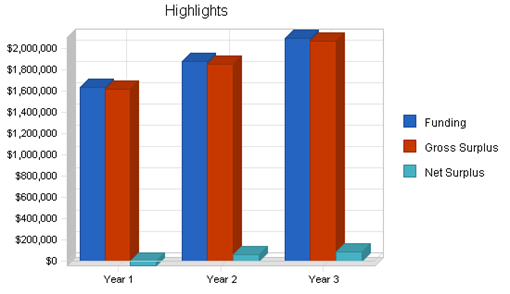

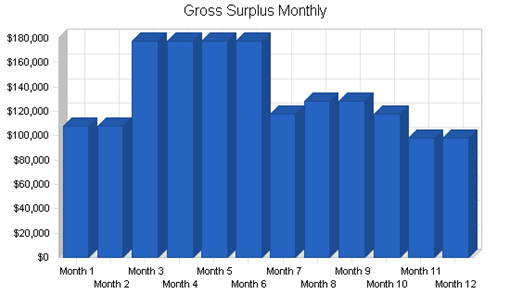

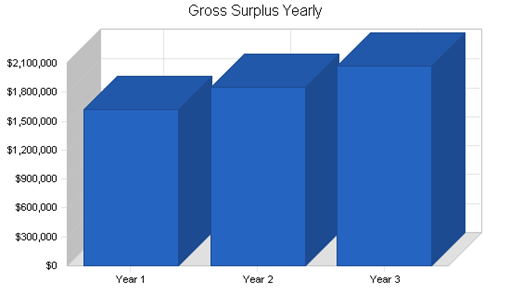

The following is the Surplus or Deficit of the program's operation for three years.

|

Surplus and Deficit |

|||

|

Year 1 |

Year 2 |

Year 3 |

|

|

Funding |

$1,640,000 |

$1,880,000 |

$2,100,000 |

|

Direct Cost |

$24,000 |

$27,000 |

$30,000 |

|

Other Production Expenses |

$0 |

$0 |

$0 |

|

Total Direct Cost |

$24,000 |

$27,000 |

$30,000 |

|

Gross Surplus |

$1,616,000 |

$1,853,000 |

$2,070,000 |

|

Gross Surplus % |

98.54% |

98.56% |

98.57% |

|

Expenses |

|||

|

Payroll |

$330,000 |

$361,000 |

$395,000 |

|

Sales and Marketing and Other Expenses |

$1,196,000 |

$1,290,000 |

$1,445,000 |

|

Depreciation |

$0 |

$0 |

$0 |

|

Leased Equipment |

$0 |

$0 |

$0 |

|

Utilities |

$2,400 |

$2,400 |

$2,400 |

|

Insurance |

$60,000 |

$60,000 |

$60,000 |

|

Rent |

$24,000 |

$24,000 |

$24,000 |

|

Payroll Taxes |

$49,500 |

$54,150 |

$59,250 |

|

Other |

$0 |

$0 |

$0 |

|

Total Operating Expenses |

$1,661,900 |

$1,791,550 |

$1,985,650 |

|

Surplus Before Interest and Taxes |

($45,900) |

$61,450 |

$84,350 |

|

EBITDA |

($45,900) |

$61,450 |

$84,350 |

|

Interest Expense |

$0 |

$0 |

$0 |

|

Taxes Incurred |

$0 |

$0 |

$0 |

|

Net Surplus |

($45,900) |

$61,450 |

$84,350 |

|

Net Surplus/Funding |

-2.80% |

3.27% |

4.02% |

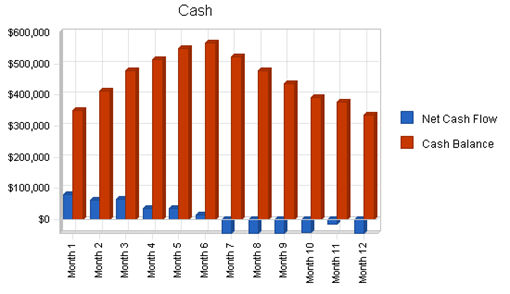

7.3 Projected Cash Flow

The following is the Projected Cash Flow of the program's operation for three years.

|

Pro Forma Cash Flow |

|||

|

Year 1 |

Year 2 |

Year 3 |

|

|

Cash Received |

|||

|

Cash from Operations |

|||

|

Cash Funding |

$1,640,000 |

$1,880,000 |

$2,100,000 |

|

Subtotal Cash from Operations |

$1,640,000 |

$1,880,000 |

$2,100,000 |

|

Additional Cash Received |

|||

|

Sales Tax, VAT, HST/GST Received |

$0 |

$0 |

$0 |

|

New Current Borrowing |

$0 |

$0 |

$0 |

|

New Other Liabilities (interest-free) |

$0 |

$0 |

$0 |

|

New Long-term Liabilities |

$0 |

$0 |

$0 |

|

Sales of Other Current Assets |

$0 |

$0 |

$0 |

|

Sales of Long-term Assets |

$0 |

$0 |

$0 |

|

New Investment Received |

$0 |

$0 |

$0 |

|

Subtotal Cash Received |

$1,640,000 |

$1,880,000 |

$2,100,000 |

|

Expenditures |

Year 1 |

Year 2 |

Year 3 |

|

Expenditures from Operations |

|||

|

Cash Spending |

$330,000 |

$361,000 |

$395,000 |

|

Bill Payments |

$1,243,453 |

$1,450,199 |

$1,607,245 |

|

Subtotal Spent on Operations |

$1,573,453 |

$1,811,199 |

$2,002,245 |

|

Additional Cash Spent |

|||

|

Sales Tax, VAT, HST/GST Paid Out |

$0 |

$0 |

$0 |

|

Principal Repayment of Current Borrowing |

$0 |

$0 |

$0 |

|

Other Liabilities Principal Repayment |

$0 |

$0 |

$0 |

|

Long-term Liabilities Principal Repayment |

$0 |

$0 |

$0 |

|

Purchase Other Current Assets |

$0 |

$0 |

$0 |

|

Purchase Long-term Assets |

$0 |

$0 |

$0 |

|

Dividends |

$0 |

$0 |

$0 |

|

Subtotal Cash Spent |

$1,573,453 |

$1,811,199 |

$2,002,245 |

|

Net Cash Flow |

$66,548 |

$68,801 |

$97,755 |

|

Cash Balance |

$334,547 |

$403,349 |

$501,104 |

7.4 Projected Balance Sheet

The following is the Projected Balance Sheet of the program's operation for three years.

|

Pro Forma Balance Sheet |

|||

|

Year 1 |

Year 2 |

Year 3 |

|

|

Assets |

|||

|

Current Assets |

|||

|

Cash |

$334,547 |

$403,349 |

$501,104 |

|

Other Current Assets |

$50,000 |

$50,000 |

$50,000 |

|

Total Current Assets |

$384,547 |

$453,349 |

$551,104 |

|

Long-term Assets |

|||

|

Long-term Assets |

$200,000 |

$200,000 |

$200,000 |

|

Accumulated Depreciation |

$0 |

$0 |

$0 |

|

Total Long-term Assets |

$200,000 |

$200,000 |

$200,000 |

|

Total Assets |

$584,547 |

$653,349 |

$751,104 |

|

Liabilities and Capital |

Year 1 |

Year 2 |

Year 3 |

|

Current Liabilities |

|||

|

Accounts Payable |

$112,448 |

$119,799 |

$133,204 |

|

Current Borrowing |

$0 |

$0 |

$0 |

|

Other Current Liabilities |

$0 |

$0 |

$0 |

|

Subtotal Current Liabilities |

$112,448 |

$119,799 |

$133,204 |

|

Long-term Liabilities |

$0 |

$0 |

$0 |

|

Total Liabilities |

$112,448 |

$119,799 |

$133,204 |

|

Paid-in Capital |

$860,000 |

$860,000 |

$860,000 |

|

Accumulated Surplus/Deficit |

($342,000) |

($387,900) |

($326,450) |

|

Surplus/Deficit |

($45,900) |

$61,450 |

$84,350 |

|

Total Capital |

$472,100 |

$533,550 |

$617,900 |

|

Total Liabilities and Capital |

$584,548 |

$653,349 |

$751,104 |

|

Net Worth |

$472,100 |

$533,550 |

$617,900 |

7.5 Standard Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7999, Amusement and Recreation, are shown for comparison.

|

Ratio Analysis |

||||

|

Year 1 |

Year 2 |

Year 3 |

Industry Profile |

|

|

Funding Growth |

0.00% |

14.63% |

11.70% |

4.07% |

|

Percent of Total Assets |

||||

|

Other Current Assets |

8.55% |

7.65% |

6.66% |

33.94% |

|

Total Current Assets |

65.79% |

69.39% |

73.37% |

42.54% |

|

Long-term Assets |

34.21% |

30.61% |

26.63% |

57.46% |

|

Total Assets |

100.00% |

100.00% |

100.00% |

100.00% |

|

Current Liabilities |

19.24% |

18.34% |

17.73% |

24.50% |

|

Long-term Liabilities |

0.00% |

0.00% |

0.00% |

23.36% |

|

Total Liabilities |

19.24% |

18.34% |

17.73% |

47.86% |

|

Net Worth |

80.76% |

81.66% |

82.27% |

52.14% |

|

Percent of Funding |

||||

|

Funding |

100.00% |

100.00% |

100.00% |

100.00% |

|

Gross Surplus |

98.54% |

98.56% |

98.57% |

100.00% |

|

Selling, General & Administrative Expenses |

101.34% |

95.30% |

94.55% |

68.43% |

|

Advertising Expenses |

2.20% |

2.13% |

2.14% |

3.66% |

|

Surplus Before Interest and Taxes |

-2.80% |

3.27% |

4.02% |

2.96% |

|

Main Ratios |

||||

|

Current |

3.42 |

3.78 |

4.14 |

1.13 |

|

Quick |

3.42 |

3.78 |

4.14 |

0.70 |

|

Total Debt to Total Assets |

19.24% |

18.34% |

17.73% |

56.09% |

|

Pre-tax Return on Net Worth |

-9.72% |

11.52% |

13.65% |

4.33% |

|

Pre-tax Return on Assets |

-7.85% |

9.41% |

11.23% |

9.87% |

|

Additional Ratios |

Year 1 |

Year 2 |

Year 3 |

|

|

Net Surplus Margin |

-2.80% |

3.27% |

4.02% |

n.a |

|

Return on Equity |

-9.72% |

11.52% |

13.65% |

n.a |

|

Activity Ratios |

||||

|

Accounts Payable Turnover |

12.06 |

12.17 |

12.17 |

n.a |

|

Payment Days |

27 |

29 |

28 |

n.a |

|

Total Asset Turnover |

2.81 |

2.88 |

2.80 |

n.a |

|

Debt Ratios |

||||

|

Debt to Net Worth |

0.24 |

0.22 |

0.22 |

n.a |

|

Current Liab. to Liab. |

1.00 |

1.00 |

1.00 |

n.a |

|

Liquidity Ratios |

||||

|

Net Working Capital |

$272,100 |

$333,550 |

$417,900 |

n.a |

|

Interest Coverage |

0.00 |

0.00 |

0.00 |

n.a |

|

Additional Ratios |

||||

|

Assets to Funding |

0.36 |

0.35 |

0.36 |

n.a |

|

Current Debt/Total Assets |

19% |

18% |

18% |

n.a |

|

Acid Test |

3.42 |

3.78 |

4.14 |

n.a |

|

Funding/Net Worth |

3.47 |

3.52 |

3.40 |

n.a |

|

Dividend Payout |

0.00 |

0.00 |

0.00 |

n.a |

Appendix

|

Funding Forecast |

|||||||||||||

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

||

|

Funding |

|||||||||||||

|

Sign-Up Fees |

0% |

$50,000 |

$50,000 |

$120,000 |

$120,000 |

$120,000 |

$120,000 |

$60,000 |

$70,000 |

$70,000 |

$60,000 |

$60,000 |

$60,000 |

|

Business Sponsorships |

0% |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$30,000 |

$30,000 |

|

Fundraising |

0% |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

$10,000 |

|

Other |

0% |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

Total Funding |

$110,000 |

$110,000 |

$180,000 |

$180,000 |

$180,000 |

$180,000 |

$120,000 |

$130,000 |

$130,000 |

$120,000 |

$100,000 |

$100,000 |

|

|

Direct Cost of Funding |

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Sign-Up Fees |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Business Sponsorships |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

|

|

Fundraising |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

$1,000 |

|

|

Other |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Subtotal Cost of Funding |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

|

|

Personnel Plan |

|||||||||||||

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

||

|

Director |

0% |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

$3,000 |

|

Assistant Director |

0% |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

$2,600 |

|

Volunteer Coordinator |

0% |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

|

Sponsorship/Fundraising Developer |

0% |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

$2,800 |

|

Facility Coordinator |

0% |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

|

Coordinator of Game Officials |

0% |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

$2,400 |

|

Area Supervisors (3) |

0% |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

$6,000 |

|

Office Manager |

0% |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

$2,500 |

|

Clerical Staff (2) |

0% |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

$3,200 |

|

Total People |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

12 |

|

|

Total Payroll |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

|

|

General Assumptions |

|||||||||||||

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

||

|

Plan Month |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

|

|

Current Interest Rate |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

|

|

Long-term Interest Rate |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

10.00% |

|

|

Tax Rate |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

|

Other |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Surplus and Deficit |

|||||||||||||

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

||

|

Funding |

$110,000 |

$110,000 |

$180,000 |

$180,000 |

$180,000 |

$180,000 |

$120,000 |

$130,000 |

$130,000 |

$120,000 |

$100,000 |

$100,000 |

|

|

Direct Cost |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

|

|

Other Production Expenses |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Total Direct Cost |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

|

|

Gross Surplus |

$108,000 |

$108,000 |

$178,000 |

$178,000 |

$178,000 |

$178,000 |

$118,000 |

$128,000 |

$128,000 |

$118,000 |

$98,000 |

$98,000 |

|

|

Gross Surplus % |

98.18% |

98.18% |

98.89% |

98.89% |

98.89% |

98.89% |

98.33% |

98.46% |

98.46% |

98.33% |

98.00% |

98.00% |

|

|

Expenses |

|||||||||||||

|

Payroll |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

|

|

Sales and Marketing and Other Expenses |

$3,000 |

$73,000 |

$103,000 |

$103,000 |

$123,000 |

$123,000 |

$133,000 |

$133,000 |

$123,000 |

$73,000 |

$103,000 |

$103,000 |

|

|

Depreciation |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Leased Equipment |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Utilities |

$200 |

$200 |

$200 |

$200 |

$200 |

$200 |

$200 |

$200 |

$200 |

$200 |

$200 |

$200 |

|

|

Insurance |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

$5,000 |

|

|

Rent |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

|

|

Payroll Taxes |

15% |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

$4,125 |

|

Other |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Total Operating Expenses |

$41,825 |

$111,825 |

$141,825 |

$141,825 |

$161,825 |

$161,825 |

$171,825 |

$171,825 |

$161,825 |

$111,825 |

$141,825 |

$141,825 |

|

|

Surplus Before Interest and Taxes |

$66,175 |

($3,825) |

$36,175 |

$36,175 |

$16,175 |

$16,175 |

($53,825) |

($43,825) |

($33,825) |

$6,175 |

($43,825) |

($43,825) |

|

|

EBITDA |

$66,175 |

($3,825) |

$36,175 |

$36,175 |

$16,175 |

$16,175 |

($53,825) |

($43,825) |

($33,825) |

$6,175 |

($43,825) |

($43,825) |

|

|

Interest Expense |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Taxes Incurred |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Net Surplus |

$66,175 |

($3,825) |

$36,175 |

$36,175 |

$16,175 |

$16,175 |

($53,825) |

($43,825) |

($33,825) |

$6,175 |

($43,825) |

($43,825) |

|

|

Net Surplus/Funding |

60.16% |

-3.48% |

20.10% |

20.10% |

8.99% |

8.99% |

-44.85% |

-33.71% |

-26.02% |

5.15% |

-43.83% |

-43.83% |

|

|

Pro Forma Cash Flow |

|||||||||||||

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

||

|

Cash Received |

|||||||||||||

|

Cash from Operations |

|||||||||||||

|

Cash Funding |

$110,000 |

$110,000 |

$180,000 |

$180,000 |

$180,000 |

$180,000 |

$120,000 |

$130,000 |

$130,000 |

$120,000 |

$100,000 |

$100,000 |

|

|

Subtotal Cash from Operations |

$110,000 |

$110,000 |

$180,000 |

$180,000 |

$180,000 |

$180,000 |

$120,000 |

$130,000 |

$130,000 |

$120,000 |

$100,000 |

$100,000 |

|

|

Additional Cash Received |

|||||||||||||

|

Sales Tax, VAT, HST/GST Received |

0.00% |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

New Current Borrowing |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

New Other Liabilities (interest-free) |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

New Long-term Liabilities |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Sales of Other Current Assets |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Sales of Long-term Assets |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

New Investment Received |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Subtotal Cash Received |

$110,000 |

$110,000 |

$180,000 |

$180,000 |

$180,000 |

$180,000 |

$120,000 |

$130,000 |

$130,000 |

$120,000 |

$100,000 |

$100,000 |

|

|

Expenditures |

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Expenditures from Operations |

|||||||||||||

|

Cash Spending |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

$27,500 |

|

|

Bill Payments |

$544 |

$18,658 |

$87,325 |

$116,325 |

$116,992 |

$136,325 |

$136,658 |

$146,325 |

$145,992 |

$134,658 |

$87,325 |

$116,325 |

|

|

Subtotal Spent on Operations |

$28,044 |

$46,158 |

$114,825 |

$143,825 |

$144,492 |

$163,825 |

$164,158 |

$173,825 |

$173,492 |

$162,158 |

$114,825 |

$143,825 |

|

|

Additional Cash Spent |

|||||||||||||

|

Sales Tax, VAT, HST/GST Paid Out |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Principal Repayment of Current Borrowing |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Other Liabilities Principal Repayment |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Long-term Liabilities Principal Repayment |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Purchase Other Current Assets |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Purchase Long-term Assets |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Dividends |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

Subtotal Cash Spent |

$28,044 |

$46,158 |

$114,825 |

$143,825 |

$144,492 |

$163,825 |

$164,158 |

$173,825 |

$173,492 |

$162,158 |

$114,825 |

$143,825 |

|

|

Net Cash Flow |

$81,956 |

$63,842 |

$65,175 |

$36,175 |

$35,508 |

$16,175 |

($44,158) |

($43,825) |

($43,492) |

($42,158) |

($14,825) |

($43,825) |

|

|

Cash Balance |

$349,956 |

$413,798 |

$478,973 |

$515,148 |

$550,656 |

$566,831 |

$522,672 |

$478,847 |

$435,356 |

$393,197 |

$378,372 |

$334,547 |

|

|

Pro Forma Balance Sheet |

|||||||||||||

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

||

|

Assets |

Starting Balances |

||||||||||||

|

Current Assets |

|||||||||||||

|

Cash |

$268,000 |

$349,956 |

$413,798 |

$478,973 |

$515,148 |

$550,656 |

$566,831 |

$522,672 |

$478,847 |

$435,356 |

$393,197 |

$378,372 |

$334,547 |

|

Other Current Assets |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

$50,000 |

|

Total Current Assets |

$318,000 |

$399,956 |

$463,798 |

$528,973 |

$565,148 |

$600,656 |

$616,831 |

$572,672 |

$528,847 |

$485,356 |

$443,197 |

$428,372 |

$384,547 |

|

Long-term Assets |

|||||||||||||

|

Long-term Assets |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

|

Accumulated Depreciation |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

Total Long-term Assets |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

$200,000 |

|

Total Assets |

$518,000 |

$599,956 |

$663,798 |

$728,973 |

$765,148 |

$800,656 |

$816,831 |

$772,672 |

$728,847 |

$685,356 |

$643,197 |

$628,372 |

$584,547 |

|

Liabilities and Capital |

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Current Liabilities |

|||||||||||||

|

Accounts Payable |

$0 |

$15,781 |

$83,448 |

$112,448 |

$112,448 |

$131,781 |

$131,781 |

$141,447 |

$141,448 |

$131,781 |

$83,448 |

$112,448 |

$112,448 |

|

Current Borrowing |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

Other Current Liabilities |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

Subtotal Current Liabilities |

$0 |

$15,781 |

$83,448 |

$112,448 |

$112,448 |

$131,781 |

$131,781 |

$141,447 |

$141,448 |

$131,781 |

$83,448 |

$112,448 |

$112,448 |

|

Long-term Liabilities |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

Total Liabilities |

$0 |

$15,781 |

$83,448 |

$112,448 |

$112,448 |

$131,781 |

$131,781 |

$141,447 |

$141,448 |

$131,781 |

$83,448 |

$112,448 |

$112,448 |

|

Paid-in Capital |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

$860,000 |

|

Accumulated Surplus/Deficit |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

($342,000) |

|

Surplus/Deficit |

$0 |

$66,175 |

$62,350 |

$98,525 |

$134,700 |

$150,875 |

$167,050 |

$113,225 |

$69,400 |

$35,575 |

$41,750 |

($2,075) |

($45,900) |

|

Total Capital |

$518,000 |

$584,175 |

$580,350 |

$616,525 |

$652,700 |

$668,875 |

$685,050 |

$631,225 |

$587,400 |

$553,575 |

$559,750 |

$515,925 |

$472,100 |

|

Total Liabilities and Capital |

$518,000 |

$599,956 |

$663,798 |

$728,973 |

$765,148 |

$800,656 |

$816,831 |

$772,673 |

$728,848 |

$685,356 |

$643,198 |

$628,373 |

$584,548 |

|

Net Worth |

$518,000 |

$584,175 |

$580,350 |

$616,525 |

$652,700 |

$668,875 |

$685,050 |

$631,225 |

$587,400 |

$553,575 |

$559,750 |

$515,925 |

$472,100 |